audit working papers should include

A number of permanent files each. Audit working papers refer to the documents prepared by or use by auditors as part of their works.

That the evidence is sufficient and appropriate.

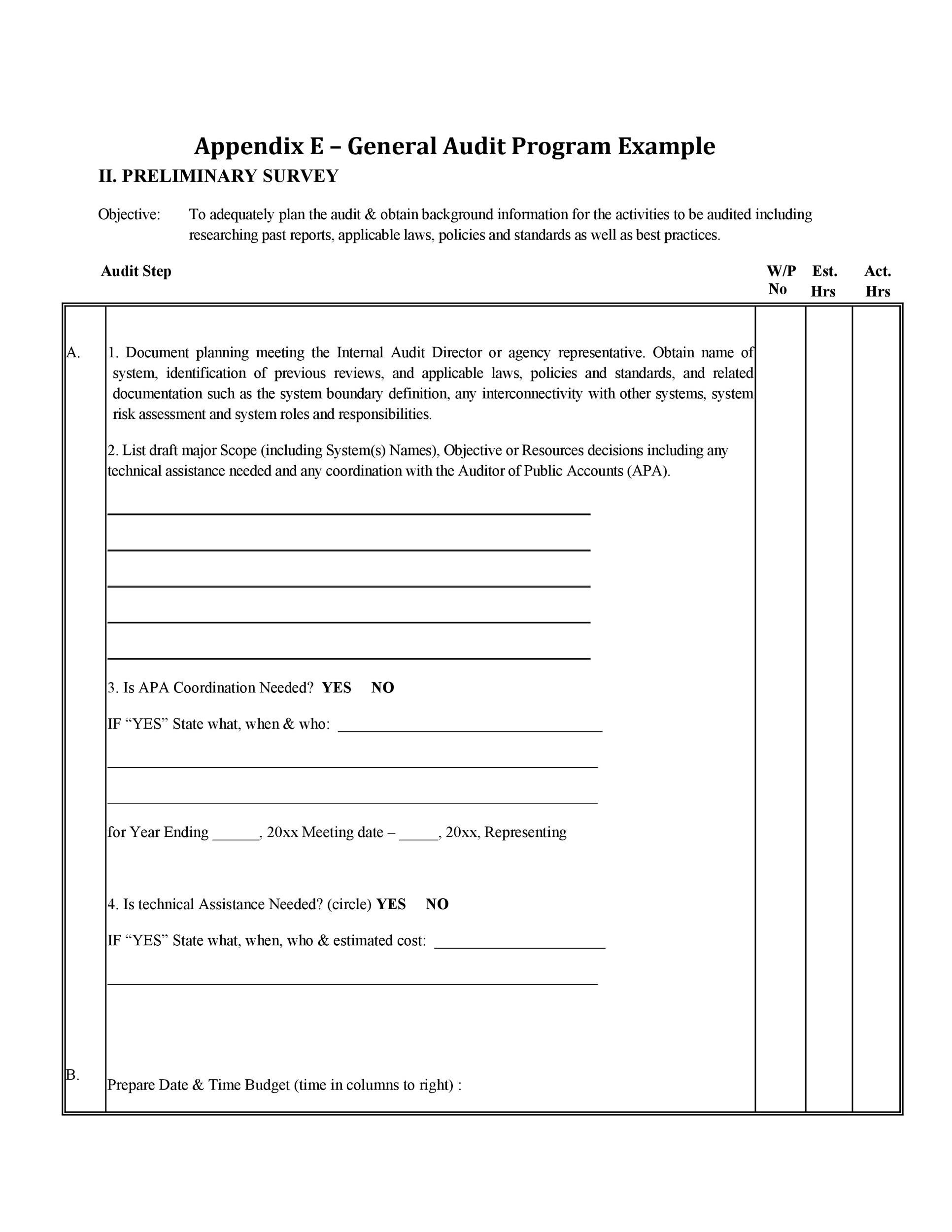

. They should contain sufficient information for an auditor who did not work on an audit to discern the reasons for. The permanent file portion of the auditors working papers generally should include a. A better audit approach so we focus on higher-value work and you focus on your business.

They show the audit was. Audit working papers are sometimes referred to as audit documents that are a. Audit working papers should include.

Working papers provide evidence that an effective audit has been carried out. The audit working papers may also include expressions of opinion. Not at all replied student B.

Working papers provide assurance that the work delegated by the audit partner has been properly completed. The name of the client The period covered The date audit working paper prepared Title subject matter Assignmentfile reference Clear cross-reference to linked documents or working papers either on a hard copy file or electronically. There was adequate supervision.

Not at all replied student B. Certificate of officials regarding certain important matters like bad debts valuation of stock unpaid expenses. A copy of key customer confirmations.

Auditors should prepare audit documentation in sufficient detail to enable an experienced auditor having no previous connection to the audit to understand from the audit documentation the nature timing extent and results of audit procedures performed the audit evidence obtained and its source and the conclusions reached including evidence that. CA copy of the financial statements. Inspection of documents or confirmation should include the identifying charac-teristics of the specific items tested21 Recording the identifying characteristics serves a number of purposes.

Information regarding unallocated work. Working papers should include all the information the auditor considers necessary to conduct the audit adequately and to provide support for the audit report. Be submitted to the client to support the financial statements and to provide.

Content that is sufficient to provide support for the auditors report including the auditors representation as to compliance with auditing standards. Time and expense reports. Help Save E Multiple Choice 33 all authorization details for overtime worked.

Typically each audit working paper must be headed with the following information. Generally audit working papers consist of the following details. Details on client ownership of individual working papers.

A copy of the financial statements b. Copies of bond and note indentures 20. The current file of the auditors working papers should generally include aA flowchart of the accounting system.

Working papers should contain facts and nothing but facts said student A. Working papers provide information on the following matters Information about audit team members and work allocated to them. Audit working papers should not A.

. A flowchart of the internal controls c. Working papers are necessary for audit quality control purposes.

Those documents include summarizing the clients nature of the business business process flow audit program or procedure documents or information obtained from the client and audit testing documents. Working papers should contain facts and nothing but facts said student A. Working papers ordinarily should include documentation showing that The work has been adequately planned and supervised indicating observance of the first standard of field work.

Schedule of debtors and creditors. Working papers helps auditor in future cases to protect himself if the client files a suit against auditor for auditors negligence while conducting the audit. The permanent file of the auditors working papers generally should include.

Names and addresses of all audit staff personnel on the engagement. Audit working papers should include-content that is sufficient to provide support for the auditors report including the auditors representation as to compliance with auditing standards-details on client ownership of individual working papers-all authorization details for overtime worked. Working papers also provide evidence that an audit was properly planned and supervised.

A sufficient understanding of internal control has been obtained to plan the audit and to determine the nature timing and extent of tests to be performed. Importance of Working Papers. Ad Our relentless focus on quality drives accurate results and transforms the audit process.

A copy of the engagement letter. Increasingly working papers are maintained in computerized files. The audit working papers may also include expressions of opinion.

They provide evidence that sufficient information was obtained by an auditor to support his or her opinion regarding the underlying financial statements. Working papers are documents developed by auditors that summarize their work including evidence tests and conclusions related to the audit objectives. The name of the client The period covered by the audit The subject matter The file reference 3 The initials signature of the member of staff who prepared the working paper and the date on which it.

Include any client-prepared papers or documents other than those prepared by the CPA or his assistant. That the appropriate review was undertaken. A copy of key customer confirmation.

A copy of the corporate charter. Names and addresses of all audit staff personnel on the engagement. Audit working papers are used to support the audit work done in order to provide assurance that the audit was performed in accordance with the relevant auditing standards.

For example it improves the ability of the auditor to supervise and review the work performed and thus demonstrates the accountability of the audit team for its work and facilitates the. The current file of the auditors working papers generally should include a. DCopies of bond and note indentures.

A copy of the engagement letter. Time and expense reports. Working papers increase the economy efficiency and effectiveness of the audit.

Be kept by the CPA after review and completion of the audit except for items required for the income tax return or the permanent file. The permanent file portion of the auditors working papers generally should include a. Regardless of the format the working papers should include some basic information.

2022 Best Internal Auditor Resume Example Myperfectresume

Payroll Audit Working Papers Templates In Ms Excel Internal Audit Paper Template Audit

Findings Report Template Fresh The Clinical Audit Report Format By Dr Mahboob Khan Phd Report Template Sample Resume How To Memorize Things

Free Audit Checklist Template Word Doc Checklist Template Word From Simple Up To Complex Content Checklist Tem Checklist Template Audit Cover Letter Sample

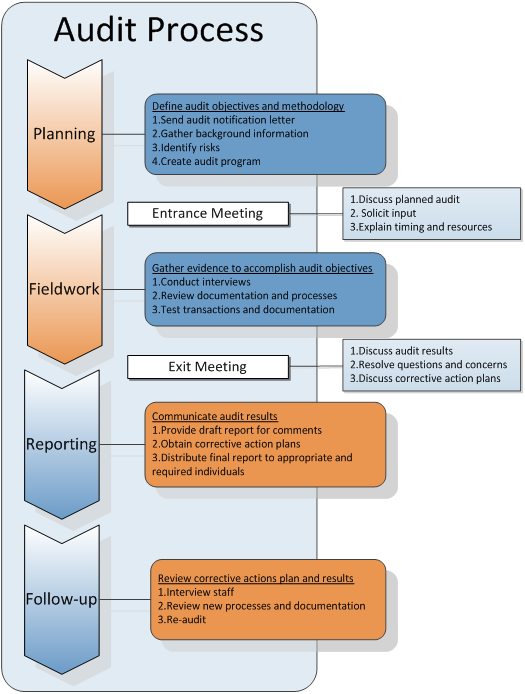

Audit Process Office Of Internal Audits

50 Free Audit Report Templates Internal Audit Reports ᐅ Templatelab

Audit Working Papers Audit Paper What Is Work

11 Importance Of Audit Working Papers Audit Disruptive Technology Change Management

Audit Checklist How To Conduct An Audit Step By Step Auditboard

Generally Accepted Auditing Standards Gaas Definition

Audit Associate Resume Samples Qwikresume

Audit Checklist How To Conduct An Audit Step By Step Auditboard

Internal Control Audit Report Template 4 Templates Example Templates Example Report Template Proposal Templates Audit

50 Free Audit Report Templates Internal Audit Reports ᐅ Templatelab